Book Summary: Secrets of the Millionaire by T. Harv Eker

This summary will explore T. Harv Eker’s Secrets of the Millionaire Mind. This enlightening book unveils the keys to mastering abundance, reshaping one’s mindset, and attaining lasting financial success. Discover how to develop a millionaire mindset and transform one’s financial future.

Adopt a mindset focused on abundance

These days, too many people hyperfocus on their results. Yet they forget a fundamental element of success: You reap what you sow. Your mindset and philosophy are assets on their own.

“You know the answers but have yet to learn to decipher them”—T. Harv Eker.

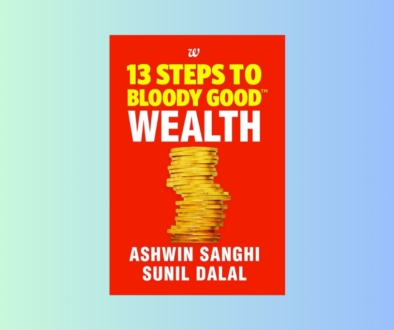

Thus, to influence the outcomes you generate, you must initiate a shift at the root level, including the physical, spiritual, emotional, and cognitive domains.

However, your physical realm is merely an output of the other three. It is the one that interacts with the outside world and feeds our spiritual, emotional, and cognitive selves. If you use your inner work wisely, it can take your wealth game to the next level. Do you want to know the rules to win? This summary will help you learn them.

“Money is a result; wealth is a result; health is a result; illness is a result; your weight is a result. We live in a world of cause and effect”—T. Harv Eker.

This summary reveals how you can alter your spiritual, emotional, and cognitive DNA to produce the results you seek in your physical life. You can become a millionaire only after you embrace the millionaire mindset.

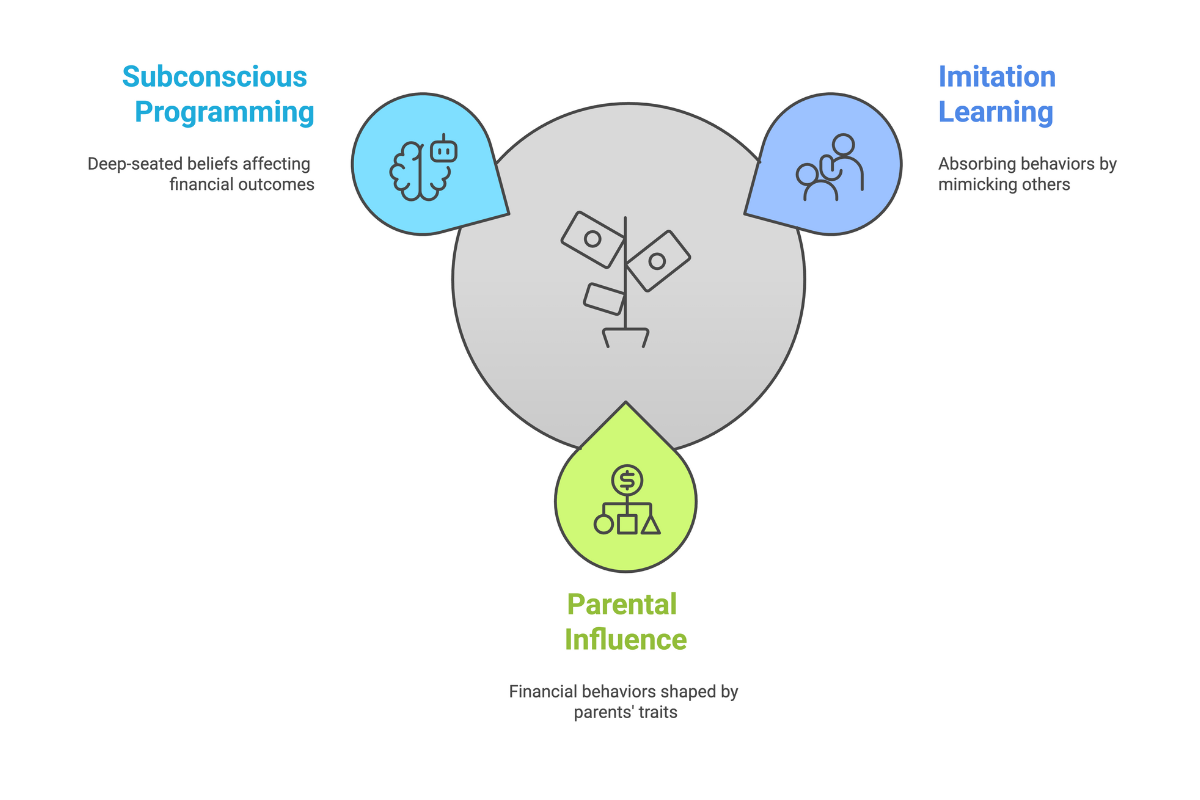

The three essential forces of conditioning

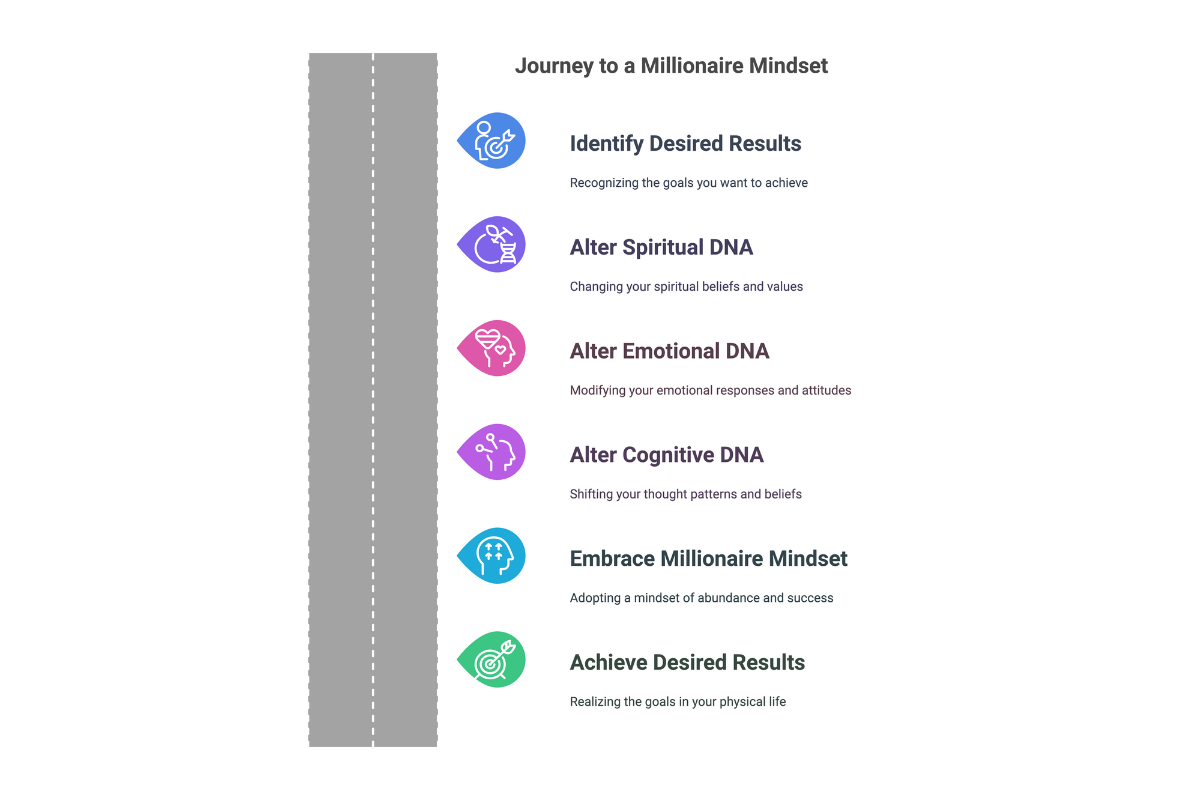

Three primary influences shape us in every aspect of life, including finances: verbal programming, modeling, and specific events.

Verbal programming

This factor is crucial because the comments you heard about money in your youth are embedded in your subconscious, forming part of the blueprint that directs your financial path. The programs installed in your subconscious mind affect how you think, make decisions, and act.

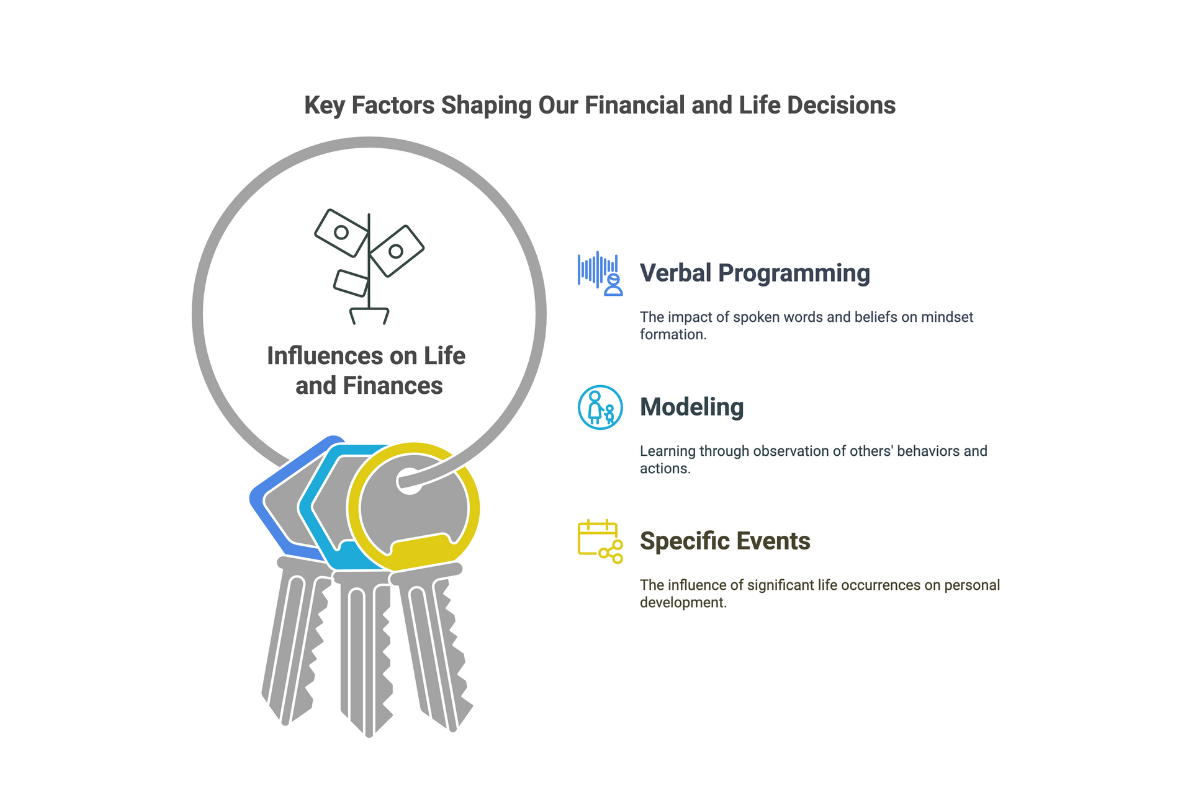

To alter and reshape your financial blueprint and destiny, four critical elements of change are necessary:

• The initial step in transformation is awareness. Recognizing the existence of an issue is the starting point for change.

• The second step is understanding. Realizing that your thought patterns originate externally is crucial for this phase.

• Thirdly, disassociation plays a key role. Depending on your self-perception and future aspirations, you can detach from negative thought patterns or maintain your existing mindset.

• Reconditioning is the final step. This strategy involves modifying your subconscious programming to replace detrimental beliefs with those that foster financial prosperity or any desired outcome.

Modeling

As children, we absorb most of our learning through imitation. Our financial behaviors often mirror our parents’ or a blend of their traits. However, possessing extensive knowledge and skills is futile if your blueprint isn’t programmed for success, leading to inevitable financial struggles.

Specific Incidents

Your early encounters with money and perceptions of wealthy individuals shape your current misconceptions or beliefs.

“Stop believing you don’t have the wealth factor. It’s literally in your head and is yours to change”—T. Harv Eker.

Harness the power of your thoughts

Your money blueprint works like a thermostat. If the room temperature is 52 degrees, the thermostat will likely also read 52 degrees.

Interestingly, if an open window lets in cold air, the room’s temperature might fall to 50 degrees. Yet, the thermostat will activate to restore the temperature to 52. Similarly, if an open window allows warm air, the room’s temperature could climb to 57 degrees. However, the thermostat will adjust it back to 52.

Reset the thermostat to change the room’s temperature permanently. Likewise, you must transform your money blueprint to elevate your financial success permanently. Regardless of your efforts in various ventures, like starting businesses, delving into real estate, or mastering the stock market, achieving lasting financial success is unlikely without a practical inner “toolbox” — a sound money blueprint.

“Consciousness lets you notice your thoughts and actions and alter them to suit your goals”—T. Harv Eker.

Being conscious allows you to acknowledge the reality of your programming — a collection of early life inputs when you were too young to discern better.

This awareness empowers us to respond aptly to situations, leveraging our full capabilities and talents rather than reacting based on outdated fears and insecurities from the past. It makes us feel capable and resourceful in the face of financial challenges.

“Each thought you have will either be an investment or a cost. It will either move you toward happiness and success or away from it”—T. Harv Eker

Adopt thoughts that support you. These are called rich thoughts. Remember, your thoughts create your emotions, which drive your actions and produce your results. To achieve wealth, it’s essential to adopt the mindset and behaviors of the affluent. This should motivate you to think and act like a wealthy individual.

According to the Standard & Poor’s Ratings Services Global Financial Literacy Survey, there is a significant gap in financial literacy across different countries.

Wise risk is the optimal choice

You already know about being active and seeking more. Now, let’s examine the other wealth files.

Wealth File 3: Affluent individuals are dedicated to achieving wealth, whereas poor people aspire to be wealthy.

Rich people do not question their desire to make money. They dedicate all their efforts to gaining more wealth and will take the necessary steps as long as they are lawful and moral.

People don’t achieve their goals of becoming wealthy because they have not subconsciously internalized the goal and are unwilling to do what it takes to achieve it.

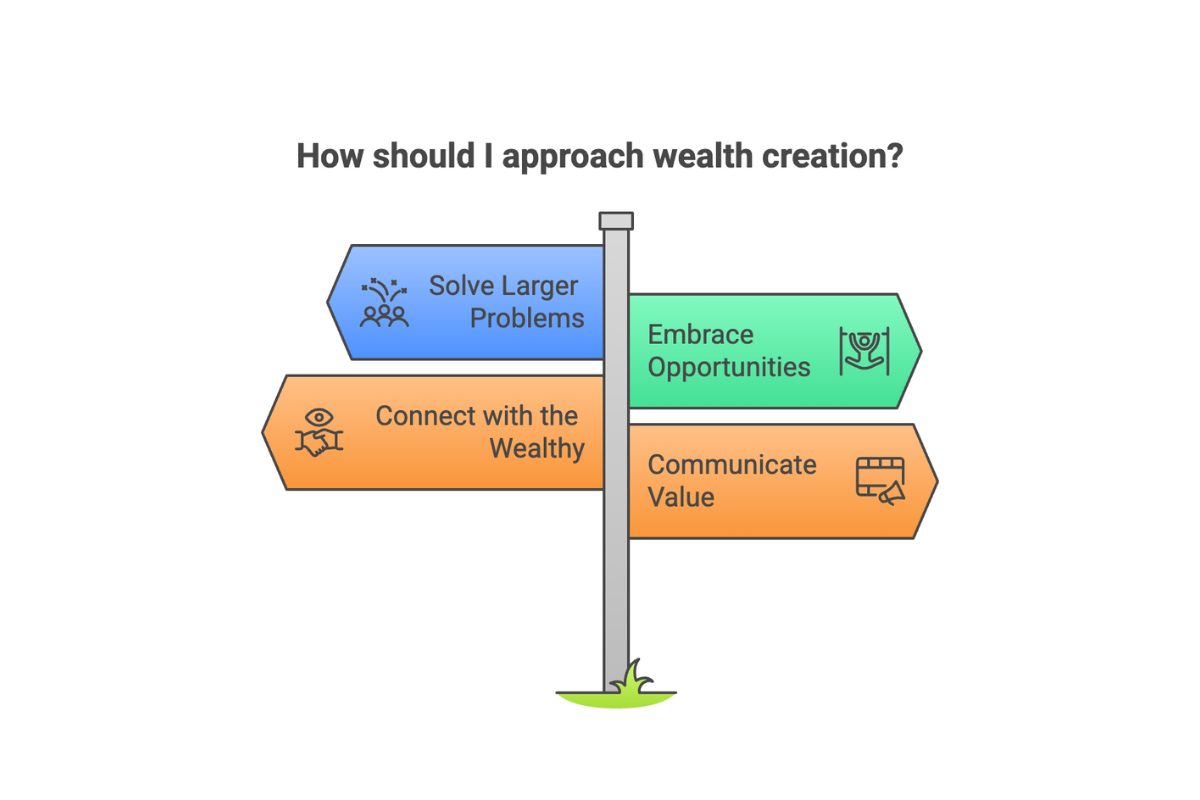

Wealth File 4: Affluent individuals think on a grand scale, while those less wealthy tend to think on a smaller scale.

The Law of Income suggests that “your earnings are proportional to the value you provide as perceived by the market.” Value, which relates to the number of people you serve or impact, is critical. Feeling insignificant or fearing failure does not lead to wealth creation.

“Being an entrepreneur means being the primary problem solver”—T. Harv Eker.

Answer the following question: Would you prefer to solve problems for a larger or smaller group? If you choose a larger group, you must think more expansively and aim at a broader audience — potentially thousands or even millions. The more people you assist, the “richer” you become financially, mentally, emotionally, and spiritually.

Wealth File 5: Wealthy individuals focus differently; they see potential where others see barriers.

Typically, less affluent individuals doubt their skills and potential. They often fear that failure will result in disastrous consequences. They consistently perceive barriers instead of seizing opportunities for wealth creation, thus avoiding taking risks. If you’re not ready to risk anything, you’re not prepared to gain rewards.

Rich people don’t take forever to learn about a particular endeavor. They engage in calculated risks. They do as much as possible in the shortest possible time and then make a well-informed decision to pursue their goals.

What you envision in your mind is what manifests in reality. If you focus on barriers, they will be the only thing you see. If you direct your efforts toward opportunities, you generate wealth. It’s quite a simple formula, but learning it takes time.

Hate is unequivocally not the answer

Finally, here’s the last portion of the wealth files to take notes on.

Wealth File 6: Poor people resent wealthy people, while rich people admire them.

When your thinking doesn’t empower you or others, you must refocus on more supportive thoughts. Certain qualities are essential to becoming wealthy, such as trustworthiness, optimism, dependability, focus, determination, perseverance, vitality, people skills, effective communication, reasonable intelligence, and proficiency in at least one domain.

“You can’t resent something and desire it simultaneously because you’ll end up disappointed and empty-handed”—T. Harv Eker

Wealth File 7: Rich people stay in rich environments while poor people move with the poor

The most effective way to accumulate wealth is by emulating other affluent individuals who have already mastered the art of creating wealth. The main rule is to adopt internal and external strategies to launch the machine. You will likely achieve similar outcomes by replicating the actions and mindsets of those who inspire you. On the other hand, poor people often react to others’ success with judgment, criticism, ridicule, and attempts to bring them down to their level.

When meeting a wealthy person, seize the opportunity to connect with them, engage in conversation, understand their thought process, exchange contact details, and develop a personal friendship if you share common interests. You must believe you possess the qualities to be rich if you want to join the millionaire gang.

In other words, emulate affluent people rather than taunt them. Rather than avoiding rich personalities, become more acquainted with them. Change the idea that they’re extraordinary by applying their “moves.” If you meet at least one rich person, you’ll realize they’re more down to earth than you thought.

Wealth File 8: Poor people have negative thoughts and feelings about selling, while rich people do not hesitate to communicate their value and promote themselves.

I want to point out that wealthy people are extraordinarily skilled at beautifully packaging their value.

Once you believe that the value you have to provide can genuinely assist people, you need to let them know about it. Don’t limit yourself to close acquaintances, colleagues, or friends. You can find a way to reach a bigger audience. In this way, you help people while getting rich at the same time.

Conclusion

Your transformation affects the world. When each of us develops a millionaire mindset, we will have a world with an abundant mentality. Elevating our awareness enables us to shift from fear to bravery and embrace abundance.

Could you determine where your mind is stuck and work to develop an abundant mentality? That way, you express control over the outcome of your life. Your thoughts also play a massive role in your reality. Your results are often a fuselage of your thoughts, feelings, and actions. Stop acting on the script you’re handed and start writing yours. Be conscious and inceptive so that others can copy your blueprint as well.

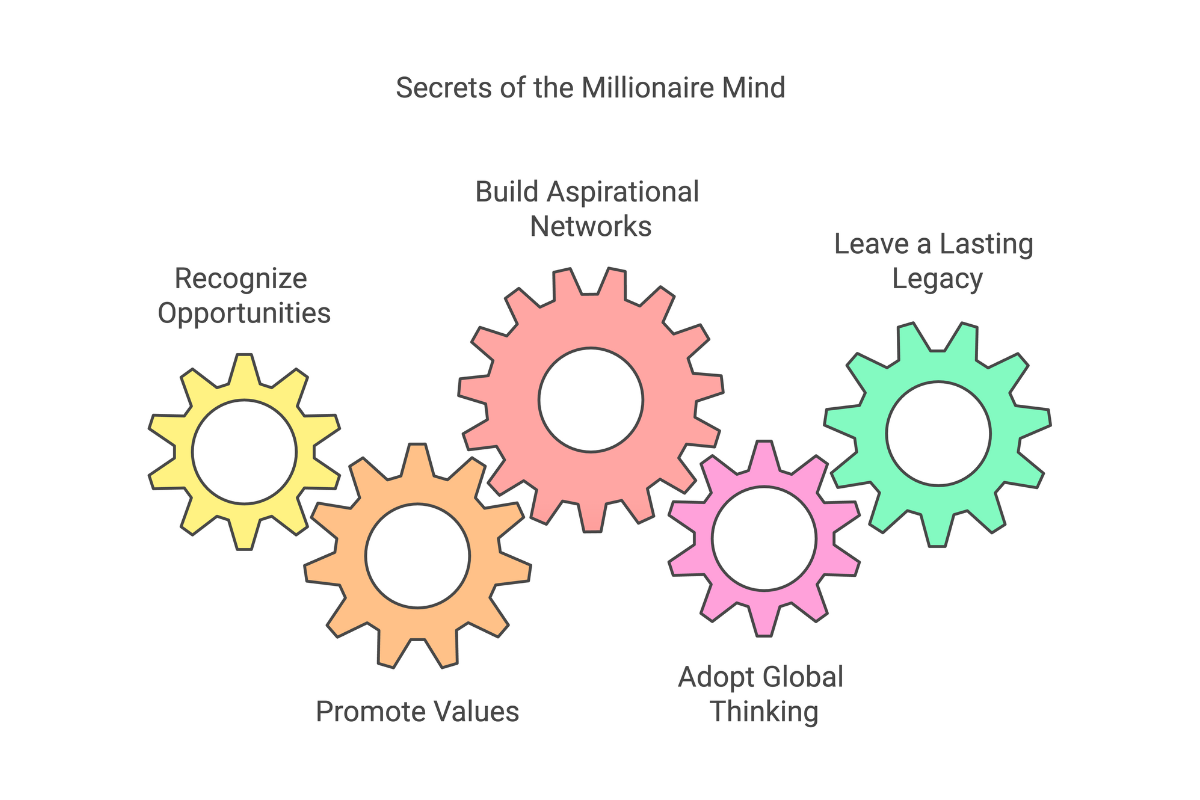

For the final recap:

• See opportunities in every obstacle.

• Promote your values.

• Associate with people you want to become.

• Learn to think globally.

Eventually, you will leave a lasting legacy by transmitting the correct beliefs to the next generation. Their subconscious minds will be programmed for wealth because you’ve done the heavy lifting by altering your DNA to attract it.